How Do Married Couples Handle Finances: 3 Important Steps

WhatToGetMy Instructional Article

- Unspoken expectations on money management in marriage can affect the quality of your relationship with your spouse. This is why discussions on how to handle finances in marriage should not start in marriage.

- Partners must be clear with each other about their financial power, potential, and expectations in the marriage.

- In this article, we will be spilling all that you need to know about how married couples handle finances to maintain peace, happiness, and growth in their marriage”.

Many tragedies in marriage are not caused by lack of money, but by mismanaging it

Martin J. Ashton

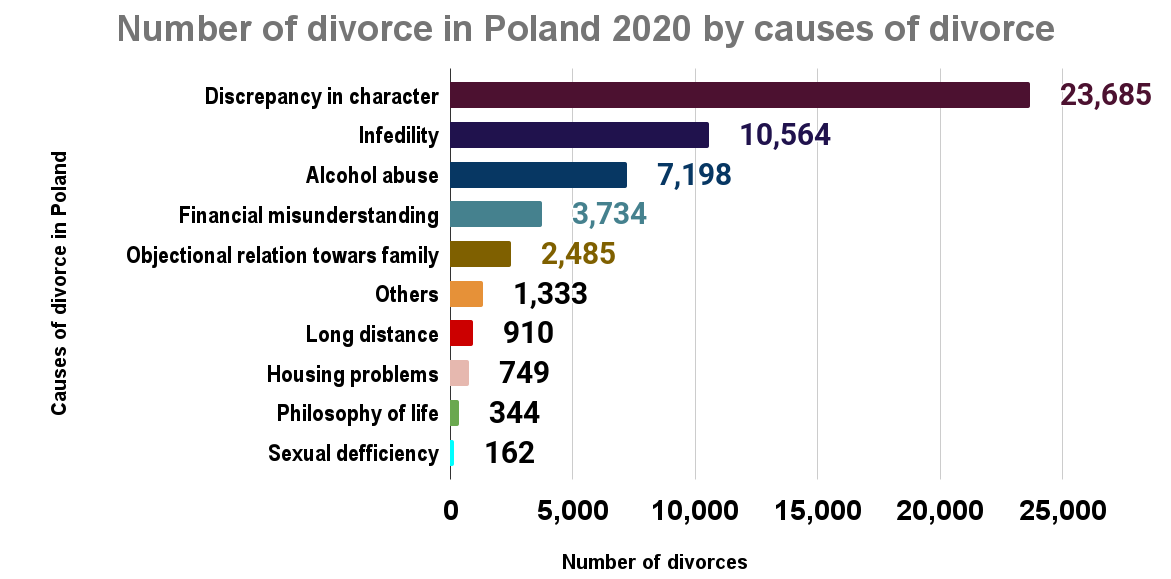

Did you know that financial misunderstanding is one of the top 4 leading causes of divorce in many countries? The 2020 statistics below is one example out of the many statistics you can find online that point to money as one of the root causes of divorce all over the world. Source: Statista.

Considering how important money is in marriages, couples should never shy away from explicitly discussing their financial expectations in marriage. They have more to gain than lose when they are transparent about money management in marriage.

Imagine being married to a woman that expects all the financial burden to be left to the man or a man that expects a woman to share equal financial burden in the home as him and yet, these expectations were never communicated with you as their partner. Imagine being married to a man that expects married couples to have a joint account or a woman that expects to maintain her individual accounts in marriage and yet you were unaware of these expectations until you got married, neither are you in agreement with them.

Unspoken monetary expectations can yield unnecessary resentments in your relationship when they are not met and this is a ticking time bomb waiting to explode. It is very unreasonable to expect your partner to know your thoughts and agree or live up to them without you saying it. In the words of Phil McGraw “if you’ve gone into marriage and you haven’t been clear about how you are going to handle money, how you want to raise kids, who is going to work or stay home or what have you, then you’ve set yourself up for failure”.

The best way for couples to manage money

How couple A handles finances in their marriage can be totally different from how couple B does and yet, both couples are right in their choices because it helps them to achieve their goals, live in harmony, and prosper as a unit. The best way for couples to manage money in marriage is to identify what works for them and stick to it on these three main issues; how to combine finances, family standards, and goals, and lastly, spending plan.

When managing finances as a couple, you and your spouse should;

1. Agree on how to combine finances when married

Agreeing on how to merge finances when married is the first step to financial planning for newly married couples, couples intending to get married, or couples that are already married but struggling to manage their finances properly.

Ask yourselves whether you need to be financing your marriage with a Separate Account, Joint Account, or with both Separate and Joint accounts. Every account has its advantages and disadvantages for both spouses but you must decide on the account that will help you and your spouse to deal with certain marital problems that stem from spending and making money in marriage. To learn more about the advantages and disadvantages of these accounts, check Investopedia for more details.

We must emphasize that couples must be completely transparent and reasonable to each other when discussing how to merge finances after marriage. Give your partner profitable reasons why a certain type of account is best suited for the marriage. It should not be a matter of “I am the head of the family” or “I am your wife” or “joining bank accounts after marriage is God’s intention for couples”. Focus on your individual strengths and weaknesses. For example, Am I an impulsive buyer? Are you a frugal spender that nags about money a lot? Am I too generous to people at the expense of my well-being and that of my family? Am I good at identifying the family’s needs and wants? etcetera.The two questions that should guide your decision as a couple should be

- How do we meet our needs, and

- How do we prosper financially and materially?

Remember, teamwork in marriage is less about self-gratification and more about achieving purpose/ goals.

2. Set family standards and goals and agree on them

The second stage to bettering your money management in marriage as a couple is to have a clear understanding of the living standards that both of you can afford and goals that must be met. Married couples handle finances a lot better when they have a strategy that helps them to continuously improve the quality of their lives. It means that they have evaluated their lifestyle choices to avoid the possibility of living above their means, spending recklessly, and lastly, failing to invest. When they evaluate their lifestyle, they take into account their incomes, assets and debts, and your opportunities. Here are a few important questions they might ask themselves when they evaluate their lifestyle;

- Is it wise to have two expensive cars we have huge debts to offset?

- Should we move to a different neighborhood to improve the quality of our lives?

- Should we get extra jobs for 6 months to cover the cost of our family trip this coming December?

- Should we buy certain appliances to increase productivity and save time in the house?

- How much must each partner deposit in the family’s savings for the next 2 years to pay off the house mortgage?

- What type of education do we want for our children and how do we adjust our earnings and savings to meet the demands?

The above questions reveal some of the goals that they’ve set for themselves and their family as a couple which are;

- Payment of debt (within a certain period of time)

- Move to a better neighborhood or a less expensive neighborhood.

- Fun family trip in December. Check out sailing vacations for couples.

- Payment of house mortgage in 2 years

- Sending their kids to prestigious schools

3. Make and stick to a spending plan.

Turner, & co. (2008) defines ‘spending plan’ as a money guide that directs where money should go. As a couple, the third step on how to manage finances in a marriage is to give your money some directions. Make a spending plan that tells you and your spouse how to break down your income. It should consist of two main expenses;

- Fixed expenses

These are costs that cannot be excused. These costs must be made every period of time. They could be your house rent, light bills, car insurance, monthly savings, loan payments etcetera.

- Flexible expenses

These are expenses that are not mandatory in comparison to fixed expenses. You and your spouse can personally determine when costs under flexible expenses can be made. For example, going to a restaurant to eat, shopping for a new wardrobe, registering for a dance class etcetera.

How married couples handle finances can weaken or strengthen their bond. With a good strategy, they can even make more money.

Factors that can affect how couples handle finances

To help you and your spouse gain more power over your finances as a couple, you need to understand what might cause conflict between the both of you when issues of money management arise.

1. Personal beliefs

When two people grow up in different environments and have been shaped by various experiences, it is normal for them to have different views on how to handle money. This is why it is important for partners to talk about money before they get married. However, if you are already married and having money frictions with your spouse, you can still have this discussion. Both of you should share your personal beliefs on money. Ask yourselves;

- How should couples split finances?

- Is joining bank accounts after marriage ideal and why?

- What is the best way for couples to manage money?

By understanding your personal beliefs on money, both of you will give yourselves a chance to reach a compromise. You might be married to a man that believes that his wife should not work but tend to the home while he becomes the sole financial provider and yet, he does not provide enough money for the family. You might be married to a woman who works as much as you do but believes that the man must cater to every financial obligation in the family. The whole situation has made you confused and frustrated and you are asking yourself “should the wife contribute financially?”

When you both confront your personal beliefs, it is important to confront them as a team and not as opponents. The goal is to identify what works best for your marriage. If you and your spouse cannot reach an agreement, it is ok to seek counseling on financial matters with your spouse. Remember, teamwork is not about personal gratification but achieving goals/ purpose.

2. Behavioral tendencies

People have different money habits. Perhaps, you know certain money habits your spouse has that have made you not trust them enough to reveal many details about your personal finances, and this is causing friction in your marriage. Your husband or wife might be impulsive buyers, they spend too much money acquiring things you don’t think are useful to the family. Worse still, he or she does it without consulting you. You might be saying right now “my wife’s spending is out of control and I just can’t trust her with managing our household finances”. You might also be saying, “my husband won’t share financial information with me as his wife”

We know how dicey money management in marriage can be especially when the situation is already out of control. However, it is important that both of you confront your money weaknesses if you wish to improve on how to handle household finances as a couple. Talk to your spouse about behaviors they exhibit that are affecting your trust in how they handle money.

3. Lack of planning and firm monetary principles

Proper money management is all about planning, coupled with having firm monetary ideals. If you and your spouse do not commit to these, you will often find yourselves struggling to keep the family afloat. As insignificant as you think making a list before for monthly shopping is, yet it is one way to teach oneself how to stick to a budget. Making a spending list will tell you how much money you have left at your disposal after catering to important needs. If you have a partner that is not thrilled about planning before spending, then you need to get them on the same page as you if both of you are serious about managing household finances as a couple.

4. External pressure

There are many external factors that could put pressure on the family and affect money management in marriage, for example, a huge loss in the family, a failed venture, debts, fire outbreak, natural disasters, financial demands from friends and relatives, medical emergencies, pledges, robbery, and the likes. While you can insure yourselves against some of these factors, the situation can get a little more complicated than expected in other situations, especially when there are no assets to fall back on.

5. Traditional or religious beliefs

It is quite common for people to be influenced by their religion or tradition. Your partner might come from a home or society that has certain monetary traditions and they expect to replicate the same tradition in the marriage, however, this might be helpful to you and the peace of your marriage. Ensure that you are aware of your financial biases that may stem from your upbringing.

FAQ

1. Should wife contribute financially?

No two marriages are the same nor have the same expectations. In some families, the wife contributes financially and in some, the wife doesn’t, yet, they live in peace, growth, and harmony. If you expect your wife to contribute financially to your marriage, it is important to speak to her about your expectations of her. It will give both of you a chance of reaching a compromise.

2. Which one of the following is the best example of a long-term goal for a young couple?

- To own a property in the 8 years of marriage

- To save $150k for children education at Harvard in 17years

- To open a business in 10 years time.

3. How should couples split finances?

How married couples handle their finances is solely up to them. What’s important is that they communicate their financial expectations in marriage with each other. It is a lot more helpful when partners with more financial power bear more financial burdens in the family.

4. Husband won’t share financial information, what should I do?

It is ideal for couples to be transparent with each other about money in the relationship. However, whether your marriage fails or succeeds should not be based on whether or not your husband reveals how much he earns.

Concluding remark

If money is enough reason for divorce, couples should never be ashamed or reluctant to discuss money management in their marriage.

01 HOUR 21 MINUTES

ESTIMATED TIME DESIGNING AND UPLOADING THIS ARTICLE

13 HOURS 39 MINUTES

ESTIMATED TIME RESEARCHING AND WRITING THIS ARTICLE

You Might Also Like

9 Helpful Tips on How to Get Your Marriage Back on Track

How to get your marriage back on track? WhatToGetMy Instructional Article No relationship is perfect. In any marriage, you are bound to hit a rough patch. There are many ways to get a marriage back on track, but it takes some work. If you are

12 Tips on How to Feel More Connected to Your Partner

12 Tips on How to Feel More Connected to Your Partner WhatToGetMy Instructional Article Your decision to learn how to feel more connected to your partner shows that you care about your relationship. It’s not uncommon to find couples struggling to maintain their connection. There

19 Fun Things For Couples To Do On A Road Trip

19 Fun Things For Couples To Do On A Road Trip WhatToGetMy Instructional Article Taking a couples’ road trip is a good bonding exercise for couples. It helps to strengthen and grow the bonds of love in the relationship. And in this article, we will

How Do Married Couples Handle Finances: 3 Important Steps

How Do Married Couples Handle Finances: 3 Important Steps WhatToGetMy Instructional Article Unspoken expectations on money management in marriage can affect the quality of your relationship with your spouse. This is why discussions on how to handle finances in marriage should not start in marriage.

31 Best Tips on How to Start a Conversation After a Fight Over a Text

31 Best Tips on How to Start a Conversation After a Fight Over a Text WhatToGetMy Instructional Article Some couples don’t know How to start a conversation after a fight over a text; this makes settling conflict difficult. When conflicts are allowed to linger for

How to Make a Guy Stop Liking You – 15 Ways to Get a Guy to Stop Liking You

How to Make a Guy Stop Liking You – 15 Ways to Get a Guy to Stop Liking You WhatToGetMy Instructional Article A relationship with a guy starts when he meets someone and likes them, and they reciprocate those feelings. This infers that the feelings

How to Tell Your Parents You’re Engaged: 7 Ways to Break the News

How to Tell Your Parents You’re Engaged: 7 Ways to Break the News WhatToGetMy Instructional Article How to tell family you’re engaged is a question that has haunted young couples for millennia. Just like any other big news in a young person’s life, an engagement

Fun Home Activities for Couples

Fun Home Activities for Couples WhatToGetMy Instructional Article Couples in long term relationships are often stuck in a routine. That’s why you’re probably looking for some great home activities for couples and you came to the right place. We’ve searched for activities that can break

Fun Things To Do After You Get Married

Fun things to do after you get married WhatToGetMy Instructional Article If you’re getting married in the very near future, you must be super very excited and nervous all at the same time. You don’t want your relationship to change in any way, so you

Why Couples Argue over the Small Things – 17 Reasons Why and Ways to Overcome It.

Why Couples Argue over the Small Things – 17 Reasons Why and Ways to Overcome It. WhatToGetMy Instructional Article Conflict is bound to happen in relationships because people are fundamentally different. What isn’t healthy, however, is this conflict being persistent and over little things, as